In the world of business, payroll is one of the most critical tasks, ensuring employees are paid accurately and on time. Traditionally, many businesses relied on manual payroll processing, but with advancements in technology, payroll software has become a popular alternative. Understanding the differences between payroll software and manual processing is essential for businesses looking to streamline their payroll processes. This article will explore the advantages and disadvantages of both approaches, helping you make an informed decision for your company.

Manual Payroll Processing: The Traditional Approach

Manual payroll processing involves calculating employee wages, deductions, taxes, and benefits by hand or using basic tools like spreadsheets. While it can be effective for small businesses with a few employees, it comes with several challenges and risks.

-

Time-Consuming: Manual payroll processing requires significant time and effort. Calculating wages, withholding taxes, and ensuring compliance with labor laws can take hours each pay period, especially if you have a large workforce.

-

Prone to Errors: Human error is a common issue with manual processing. Simple mistakes, such as miscalculating overtime or incorrectly applying deductions, can lead to incorrect paychecks, compliance issues, or unhappy employees.

-

Compliance Challenges: Keeping up with constantly changing tax laws, benefits regulations, and other compliance requirements can be difficult without automated systems. Manual processing increases the risk of errors that could lead to penalties or fines.

-

Limited Reporting and Analytics: With manual payroll, generating detailed reports or tracking key performance metrics can be cumbersome. This lack of insight can hinder your ability to make informed business decisions or respond to employee inquiries effectively.

Payroll Software: The Modern Solution

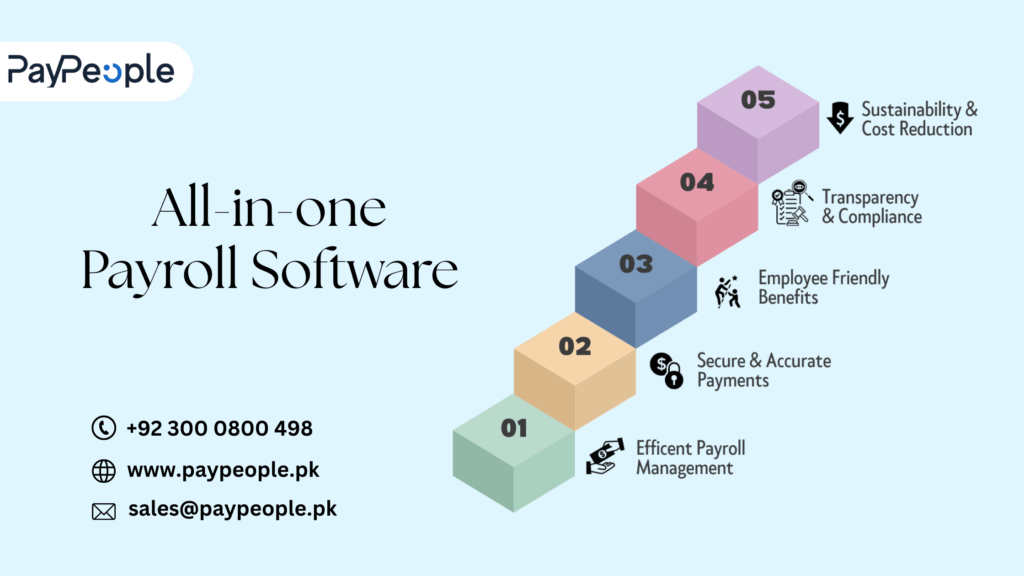

Payroll software automates the entire payroll process, from calculating wages to generating payslips and ensuring tax compliance. Whether hosted on the cloud or installed on local servers, these tools offer a range of benefits that make them increasingly popular among businesses of all sizes.

-

Time Efficiency: One of the most significant advantages of payroll software is the time saved. Automation speeds up tasks like calculating payroll, applying tax rates, and ensuring correct deductions. This enables businesses to process payroll in minutes rather than hours.

-

Accuracy and Reduced Errors: Payroll software is designed to minimize human errors. These systems are programmed with the latest tax rules and deductions, ensuring that all calculations are accurate and compliant with government regulations. This reduces the risk of costly mistakes that could result in penalties or disgruntled employees.

-

Compliance Assurance: Payroll software is regularly updated to reflect changes in tax laws and employment regulations, ensuring that your business stays compliant without manual intervention. Many software solutions also offer automatic tax filings and year-end reporting, further reducing the burden on payroll administrators.

-

Detailed Reporting and Analytics: Payroll software offers comprehensive reporting features that allow businesses to track key metrics, generate custom reports, and analyze payroll data. This level of insight can help business owners make data-driven decisions and improve financial planning.

-

Scalability: As your business grows, so does your payroll. Payroll software can easily accommodate increasing numbers of employees, changing pay structures, and complex benefit plans, making it a scalable solution for growing businesses.

Key Differences: Payroll Software vs. Manual Processing

| Feature | Manual Processing | Payroll Software |

|---|---|---|

| Time Efficiency | Time-consuming and labor-intensive | Automated, faster processing |

| Accuracy | Prone to human errors | Reduces errors with automated calculations |

| Compliance | Risk of falling behind on tax laws and regulations | Regular updates ensure compliance |

| Reporting & Analytics | Limited or no reporting features | Detailed reports and data analysis are available |

| Cost | No software fees, but time-consuming | Subscription or licensing fees, but more efficient overall |

| Scalability | Challenging to scale with company growth | Easily scalable as the business expands |

Conclusion

Both manual payroll processing and payroll software have their place, but for most businesses, the advantages of payroll software far outweigh the drawbacks of manual systems. While manual processing may still work for small businesses with a handful of employees, businesses looking to scale, improve efficiency, and ensure compliance will benefit greatly from the automation and accuracy that payroll software provides. By investing in the right payroll software, you can save time, reduce errors, and ensure that your employees are paid correctly and on time every pay period.

You can explore our other blogs like:

- The Future of Payroll: Trends in Payroll Software

- Understanding Performance Management Systems in 2025

- PayPeople: A Leading Payroll Software in Pakistan